Top business executives joined the UN chief on Wednesday to present transformative solutions for bridging the estimated $4.3 trillion-dollar financing gap for countries the reach the ambitious 2030 Sustainable Development Goals (SDGs) - the world’s agreed roadmap for a more peaceful and inclusive world.

The Fourth Annual Meeting of the Global Investors for Sustainable Development (GISD) Alliance, is focused on supporting developing countries on the road to meeting the SDGs, and it took place at UN Headquarters in New York amid a worsening global economic outlook brought on by war in Ukraine, climate change, and COVID-19 – all of which is threatening long-term investment, said a press release issued by GISD

‘No time to waste’

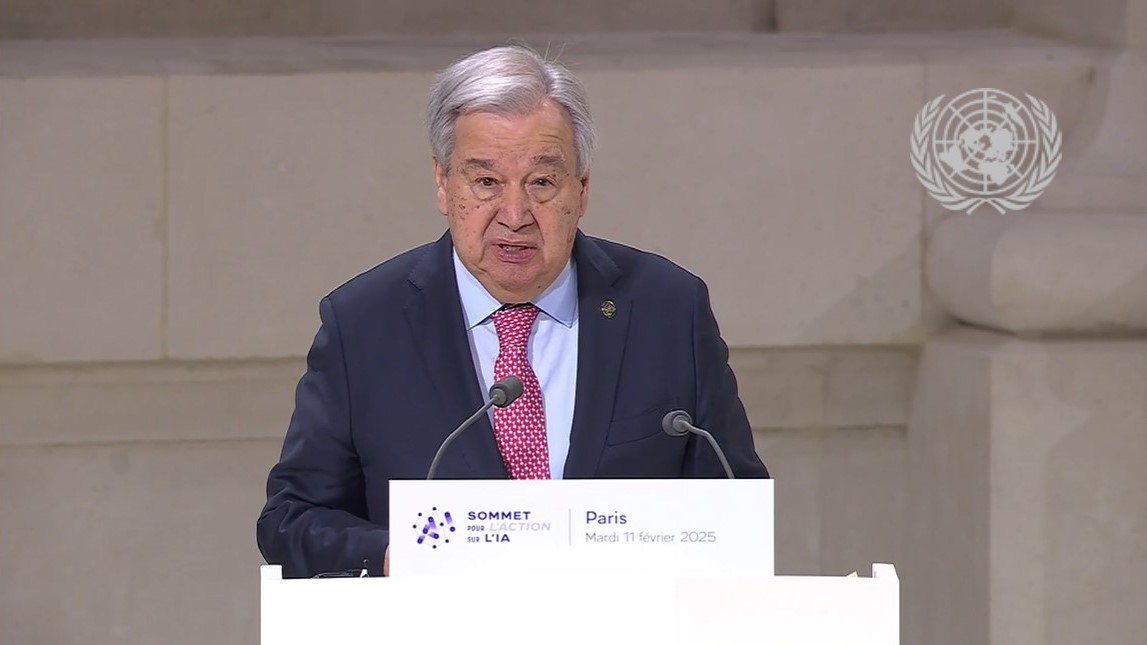

“The large and persistent SDG financing gap must spur our collective effort to scale up private finance and investment for the SDGs. There is no time to waste. We cannot afford for the SDGs to fall out of reach,” said UN Secretary-General António Guterres.

The GISD Alliance — convened by the Secretary-General in 2019 — consists of prominent business leaders from across the world, including the heads of Standard Chartered, Pimco, Citibank and Investec.

Finance boost

It seeks to align, scale up, and accelerate finance and investment for the 17 Goals. The GISD Alliance is led by co-Chairs Leila Fourie, Chief Executive Officer of the Johannesburg Stock Exchange, and José Viñals, Group Chairman of Standard Chartered.

“In the past year, building on pivotal work done in the preceding years, the GISD Alliance has focused on setting conditions for the scaling up of long-term private finance for sustainable development investment (SDI),” said Ms. Fourie.

“This was accomplished through the development of a credible definition for SDI, SDG-aligned metrics, a Model Mandate to assist in developing SDI strategies, making input into the development of a set of global sustainability reporting standards, and a roadmap for necessary MDB reforms.”

New initiatives

Mr. Viñals said that during the next 12 months, the Alliance would “continue to scale up these efforts and embark on new initiatives, launching a transformational blended finance platform that will allow for co-investment in sustainable infrastructure projects.

“We will also continue our engagement with global stakeholders to advance the reforms necessary to unlock finance and investment for sustainable development in support of the SDGs.”

To facilitate the flow of investments to developing countries, the Alliance is advocating for more effective private capital mobilization by multilateral development banks and the overall international development system.

GISD Members have made recommendations on changes to governance and business models of development banks and improved finance structures.

New standards

Since its launch, the Alliance has developed standards and tools to align investment portfolios with the SDGs, including a unified definition of Sustainable Development Investing (SDI) and SDG-aligned, sector-specific metrics that strengthen reporting and enable a credible comparison of SDG performance within and between different industries.

GISD highlighted the case of Aware Super, a pension fund based in Australia with AU$150 billion in assets, which has now incorporated the SDI definition as part of its investment due diligence.

Most recently, in collaboration with the International Corporate Governance Network (ICGN), the Alliance launched the Model Mandate, which provides guidance on the contractual relationships between asset owners and asset managers, with a focus on encouraging long-term investments that are aligned with the SDGs.

Co-invest for the future

The GISD Alliance has also submitted a collective response to the public consultation of the International Sustainability Standards Board, established at COP26, to develop a comprehensive global baseline of sustainability disclosures for capital markets.

In addition, the GISD Alliance is moving towards launching the Sustainable Infrastructure Investment Platform (SIIP) which will allow multiple multilateral development banks and institutional investors, to co-invest in SDG-aligned infrastructure and scale investments up in emerging markets.

The UN chief convened the Alliance to find solutions to mobilize investment in the SDGs as part of the implementation of his Strategy for Financing the 2030 Agenda for Sustainable Development. Members control assets worth $16 trillion.

Celebrity Media TV

Celebrity Media TV